child tax credit after december 2021

Enter your information on Schedule 8812 Form. Monthly child tax credit expires Friday after Congress failed to renew it Because the Build Back Better agenda was not passed by the Senate before the end of the year.

What To Know About The Child Tax Credit The New York Times

There will be no advance payments of the credit starting in January and the credit amount will be up to 2000 for each child under age 17.

. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. December 15 2021 830 AM MoneyWatch Monthly Child Tax Credit checks could stop Monthly Child Tax Credit checks set to end if. The only caveat to this is if you and your childs other parent dont live.

The refundable Additional Child Tax Credit will be 1400 per child. Under the American Rescue Plan Act of 2021 the new Child Tax Credit is a refundable credit worth up to 3600 per qualifying child under 18. Get your advance payments total and number of qualifying children in your online account.

3000 for children ages 6 through 17 at the end of 2021. For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17. Claim the full Child Tax Credit on the 2021 tax return.

The American Rescue Plan allowed 17-year-olds to qualify for the Child Tax Credit. If the family in this example received advance payments totaling 1800 from July through December 2021. The tax credits maximum amount is 3000 per child and 3600 for children under 6.

Previously only children 16 and younger qualified. The advance is 50 of your child tax credit with the rest claimed on next years return. This means that parents or legal guardians of children under 18 could be eligible for a larger credit than they were in 2020 depending on their income.

In 2021 then you will receive the child tax credit so long as your income is below 440000 if youre married and filing jointly. Check mailed to a foreign address. When you file your 2021 taxes you can expect to receive up to 1800 for each child aged five and under.

Youll need to print and mail the. December 10 2021 at 700 am. The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only.

The credits scope has been expanded. Washington Post IllustrationiStock Placeholder while article actions load. Increases the tax credit amount.

The 500 nonrefundable Credit for Other Dependents amount has not changed. Child tax credit after december 2021 Friday May 20 2022 Edit. The maximum Child Tax Credit increased to 3600 for children under the age of 6 and to 3000 per child for children between ages 6 and 17.

The remaining 1800 will be. Complete IRS Tax Forms Online or Print Government Tax Documents. The expanded child tax credit under which parents got up to 300 a month per kid lasted from July to December 2021.

Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month. The 2021 CTC is different than before in 6 key ways. 3600 for children ages 5 and under at the end of 2021.

Unless Congress acts the last of the advance child tax credit payments. The Child Tax Credit reverts to the 2020 level in 2022 unless Congress chooses to extend some or all of the temporary changes for 2021. When the American Rescue Plan Act of 2021 was signed into law on March 11 it temporarily amended the child tax credit for the 2021 tax year.

The 2021 child tax credit provides parents with up to 3600 per child for kids under 6 and 3000 for all other children under 18 with half of the money being doled out as. The American Rescue. Makes the credit fully refundable.

The enhanced child tax credit for 2021 gives non-filers more reason to file a return. At first glance the steps to request a payment trace can look daunting. Many eligible taxpayers received monthly advance payments of half of their estimated 2021 Child Tax Credit amounts during 2021 from July through December.

Eligibility is based on your childs age at the end of this calendar year. After checking that you and the family meet the income eligibility requirements and you received the advanced payments last year between July and December come tax filing you can expect to receive the second half of payments. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

December 30 2021 203. Qualifying families will receive half of their credit divided into 6 monthly payments deposited from July to December 2021. Eligible families have received monthly payments of up.

Removes the minimum income requirement. Find out if they are eligible to receive the Child Tax Credit. Treasury sends the first monthly round of CTC advance payments to families of more than 60 million children.

Understand how the 2021 Child Tax Credit works. To reconcile advance payments on your 2021 return. The program helped keep millions of children fed and out of poverty.

That means all qualifying children there are other requirements we explain below born. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. In TurboTax Online to claim the Recovery Rebate credit please do the following.

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. Your newborn should be eligible for the Child Tax credit of 3600. Even if you dont owe taxes you could get the full CTC refund.

Signed into law by President Joe Biden on March 11 2021 The American Rescue Plan increased the child tax credit to 3600 for children under the age of six and 3000 for children ages six through 17. In addition taxpayers eligible for a child tax credit wont have to. If you did not receive the stimulus for a dependent you can claim it on your 2021 tax return as the Recovery Rebate Credit.

Businesses and Self Employed. All working families will get the full credit if they make up to 150000 for a couple or 112500 for a family with a single parent head of. A childs age determines the amount.

Your newborn child is eligible for the the third stimulus of 1400. Congress fails to renew the advance Child Tax Credit. Parents income matters too.

Ad The new advance Child Tax Credit is based on your previously filed tax return. The credit amounts will increase for many taxpayers. The IRS sent out the last monthly infusion of the expanded child tax credit Wednesday -- unless Congress acts to extend it for another year.

It doesnt matter if they were born on January 1 at 1201 am. Or December 31 at 1159 pm if your child was born in the US. Get the Child Tax Credit.

These changes are an increase from last years Child Tax Credit benefit of 2000. It provides information about the Child Tax Credit and the monthly advance payments made from July through December of 2021. Understand that the credit does not affect their federal benefits.

Child Tax Credit Children 18 And Older Not Eligible Abc10 Com

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Missing A Child Tax Credit Payment Here S How To Track It Cnet

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

/cdn.vox-cdn.com/uploads/chorus_asset/file/23392681/1235261204.jpg)

Why Did Congress Let The Expanded Child Tax Credit Expire Vox

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

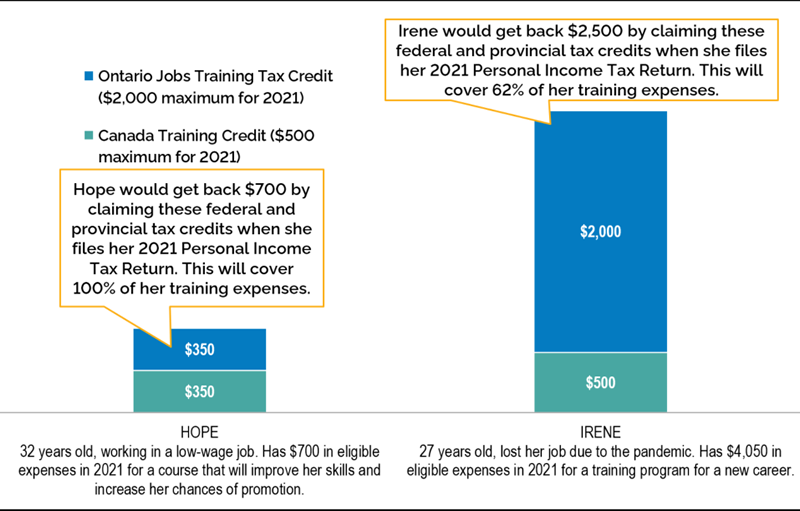

Ontario Jobs Training Tax Credit Ontario Ca

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Child Tax Credit 2022 Could You Receive A Double Monthly Payment In February Marca

The Child Tax Credit Toolkit The White House

Child Tax Credit Definition Taxedu Tax Foundation

Child Tax Credit Here S Why Your Payment Is Lower Than You Expected The Washington Post

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Child Tax Credit Schedule 8812 H R Block

Parents Guide To The Child Tax Credit Nextadvisor With Time

The Child Tax Credit Toolkit The White House

Child Tax Credit Children 18 And Older Not Eligible Abc10 Com

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca